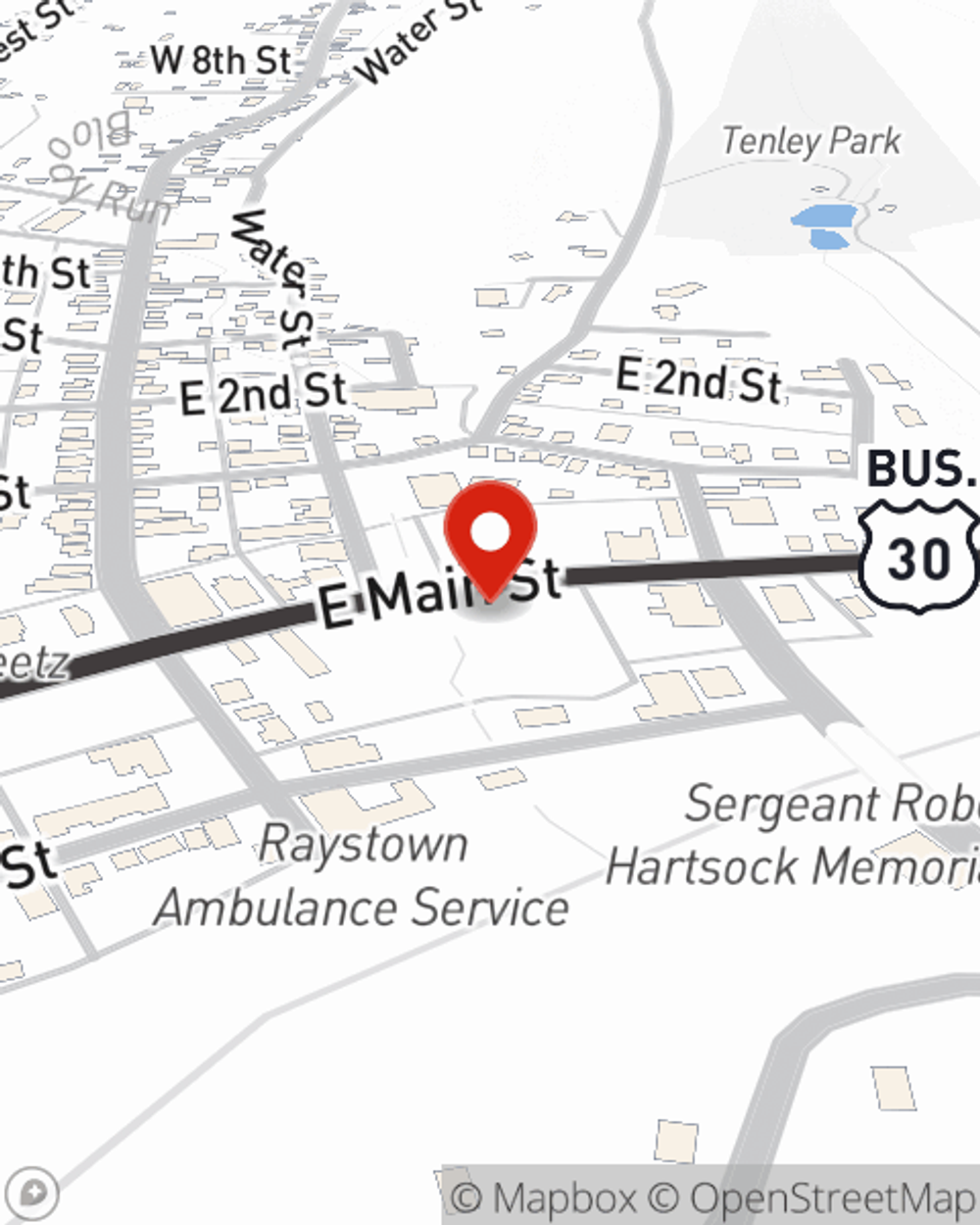

Business Insurance in and around Everett

One of the top small business insurance companies in Everett, and beyond.

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

You've put a lot of blood, sweat, and tears into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a fabric store, a pet groomer, a tailoring service, or other.

One of the top small business insurance companies in Everett, and beyond.

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Brad Will. With an agent like Brad Will, your coverage can include great options, such as worker’s compensation, business owners policies and artisan and service contractors.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Brad Will is here to help you discover your options. Reach out today!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Brad Will

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".